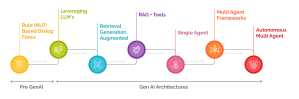

In Part 1, we had outlined how AI architectures have evolved from rule-based systems to RAG with tools integration. In this blog, we will look at emerging technologies will shape the future of customer service for the P&C insurance industry.

This blog looks at the next generation of AI ‘Agentic Architectures’ for customer service in P&C insurance – single-agent systems, multi-agent frameworks and autonomous multi-agent systems. These next generation architectures promise to dramatically simplify customer interaction and manage complex multi-step process executions.

Single Agent Systems: Cohesive End-to-End Task Completion

The next phase of AI solutions are the development of complex single-agent systems. The AI agent would be able to perform complex, end-to-end tasks with enhanced contextual retention.

Key features:

- Combines planning and execution capabilities of LLMs

- Ability to break complex queries into a sequence of steps that can be handled

- Improved personalization by retaining context during customer conversations

While AI agents are a tremendous advancement, they can’t deal with very complex, multi-faceted tasks which involve different forms of expertise or can be executed in parallel.

Multi-Agent Frameworks: Collaborative Problem-Solving To effectively deal with more complex situations, the industry is looking at multi-agent frameworks. In this design, solutions utilize numerous AI agents that play distinct roles and have distinct specialties to jointly work on customer queries.

Strengths:

- Handle complex, multi-step activities

- Helps promote extensibility and the use of parallel processing

- Specialized agents for individual domains (for example, policy expert, claims specialist, risk assessor)

These architectures make it possible to achieve substantially greater control and completeness in responding to customers’ needs when dealing with multiple coverage types or complex underwriting procedures.

Self-Evolving Multi-Agent Systems: Proactive and Self-Improving The next evolution of these architectures is the design of autonomous multi-agent systems. These agents not only respond to customers’ requests but can provide proactive advise predict problems and prevent their arising.

Important features:

- Ability to independently design, carry out, and control complex workflows

- Proactive problem-solving and continuous self-improvement

- Possible for predictive servicing where the needs of a customer are met before they have arisen

These architectures employ methods like Reflexion, RAISE (Reflect, Act, and Improve from Self-Evaluation), meta-prompting, to continually enhance their ability to make decisions and improve with experience.

Impact for the P&C Insurance Industry

These advanced AI architectures will probably change the way customer services would be rendered in the following ways

- Operational Efficiency. Complex automation procedures would only reduce the burden on human agents to spend more time on high-value work.

- Risk management: Better risk and fraud detection leading to better price competition.

- Product Innovation: Insights from AI could result in a complete makeover of how exactly tailored insurance products and services can be developed.

- Regulatory Compliance: Enhances the ability to keep pace with changes in regulations and provide compliant communications to customers.

While Agentic Architectures bring great benefits, they also put forth new challenges that need careful consideration

- Ethics: Scenarios whereby these automated system responses are free-from-bias and fair play decisions.

- Data Privacy and Security: Respect for confidential information about clients.

- Integration with Legacy Systems: Many insurers will be hard-pressed in integrating such high-end AI architectures with legacy systems.

- Transparency and Explainability: The general ability of the AI system to explain to customers and regulators how it works will be the greatest requirement of all.

Changes in the architecture of Gen AI for P&C insurance customer service are going to be extremely transformative. It begins with coherent single-agent systems to independent multiagent frameworks, promising customers a smoother experience and more rapid operations and innovation routes.

Further ahead, successful deployment of these technologies will require a delicate balancing act that taps the benefit of AI capabilities without causing disruptions around transparency and ensures that the human touch, which customers value, remains in place. In this new landscape, only those insurers who can navigate these waters well will end up at the forefront for the next era of P&C insurance customer service.